PropNex Picks

|September 11,2024Pullback in August's HDB Resale Volume due to Ghost Month

Share this article:

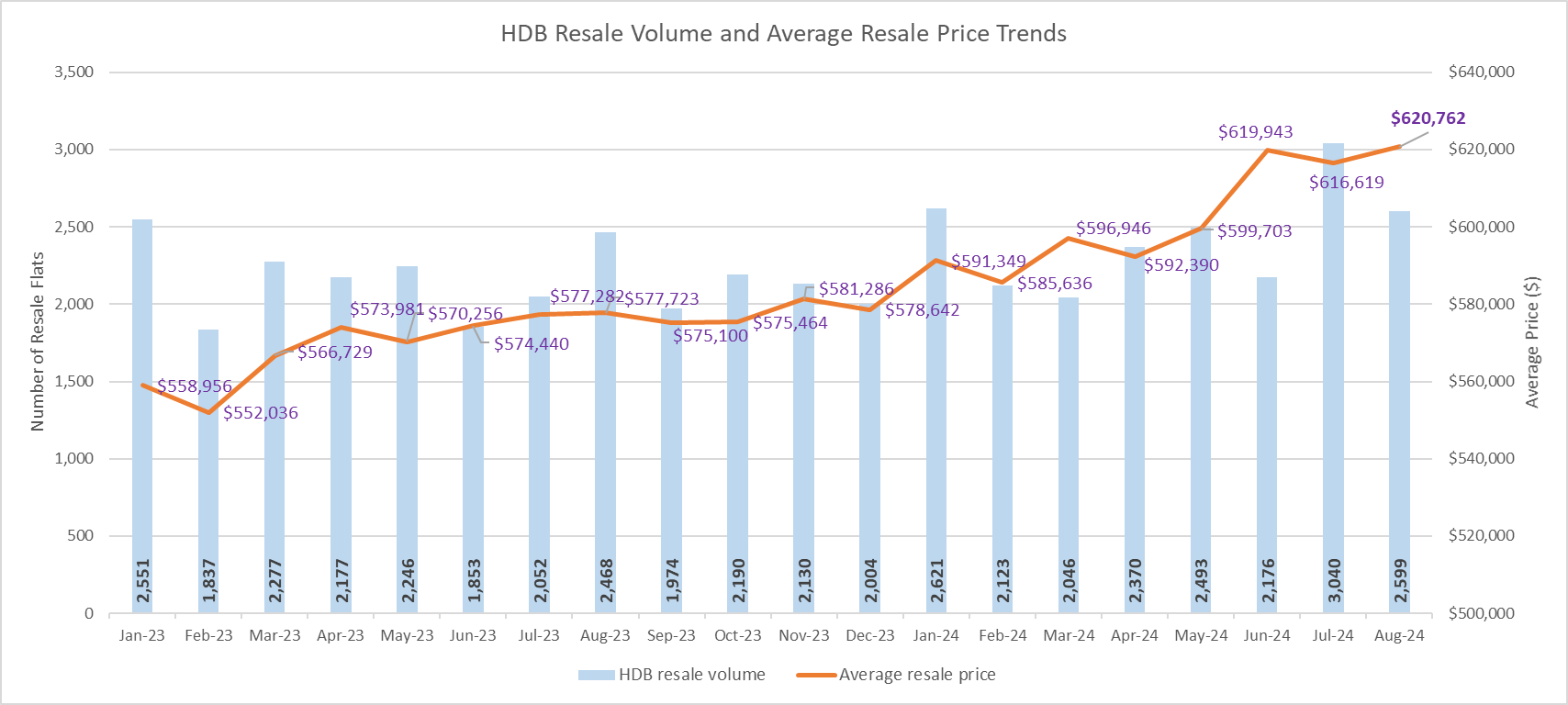

It was that time of the year where some people refrain from transacting properties. The seasonal Ghost Month effect likely took hold in the HDB resale market in August, as the sales volume eased by 14.5% month-on-month with 2,599 flats changing hands. This comes as July witnessed a healthy 40% MOM rebound in resale volume to 3,040 units (see Chart 1).

Although cooling measures - lowering of the loan-to-value (LTV) limit to 75% for HDB loans - were introduced to tame the HDB resale price growth, any potential impact may not be obvious in August's transactions, as the cut in LTV limit only came into effect on or after 20 August 2024. In addition, the Ghost Month would put a drag on sales as well.

Potential impact of new cooling measures

If anything, the market will probably get a fuller picture of the effects of the recent cooling measures in the months to come. Having said that, the government indicated that the LTV reduction would impact 10% of flat buyers who take out an HDB loan, and vast majority of buyers will not be affected.

It was reported that the proportion of resale flat buyers who took an HDB loan was 53% in 2023, as well as in the first half of 2024. And since the LTV reduction will affect 10% of those who take an HDB loan, one could infer that the measure will impact about 5% of HDB resale transactions. Using 2023's resale volume of 26,735 flats as an illustration, it would mean that more than 1,300 transactions could be affected. PropNex anticipates that the LTV cut could potentially rein in demand slightly at the top end of the HDB resale market.

Chart 1: HDB resale flat transaction volume and average resale price by month

Average resale price climbed despite lower sales

Despite the fall in the resale volume in August, the average resale price inched up by 0.7% MOM to about $621,000, based on transaction data (Chart 1). Looking at selected flat types in mature and non-mature towns, it was observed that the average resale price of 3-room to executive flats in non-mature estates all posted monthly growth ranging from 0.7% to 1.2% MOM in August (see Table 1). Meanwhile, in mature towns, executive flats posted the sharpest average price increase from July to August, where prices rose by 2.9% MOM to about $1 million (see Table 1).

Table 1: Average transacted HDB resale flat prices in Mature and Non-mature towns

| Flat Type | Mature towns | Non-mature towns | ||||

Jul-24 | Aug-24 | % change MOM | Jul-24 | Aug-24 | % change MOM | |

3 ROOM | $449,786 | $451,290 | 0.3% | $433,264 | $436,451 | 0.7% |

4 ROOM | $749,056 | $715,581 | -4.5% | $576,392 | $582,265 | 1.0% |

5 ROOM | $849,889 | $847,452 | -0.3% | $676,388 | $684,383 | 1.2% |

EXECUTIVE | $972,738 | $1,001,288 | 2.9% | $835,710 | $837,939 | 0.3% |

Similarly, executive flats led the average resale price increase by flat type (see Table 2), booking a 1.8% MOM growth to about $898,000. based on resale flat transactions islandwide. This could be due to the higher number of executive flats being resold for at least $1 million in August. It is followed by 5-room flats which saw the average resale price ticked up by 0.6% MOM in August to nearly $734,000.

Table 2: Average transacted HDB resale flat prices by Flat Type in last six months

Flat Type | Mar-24 | Apr-24 | May-24 | Jun-24 | Jul-24 | Aug-24 | MOM % change |

3-ROOM | $423,526 | $430,961 | $432,226 | $442,068 | $443,582 | $445,383 | 0.4% |

4-ROOM | $610,396 | $605,043 | $613,124 | $634,692 | $639,075 | $628,694 | -1.6% |

5-ROOM | $706,353 | $710,615 | $718,076 | $743,971 | $728,213 | $733,806 | 0.8% |

EXECUTIVE | $851,162 | $871,600 | $857,144 | $876,113 | $882,217 | $897,892 | 1.8% |

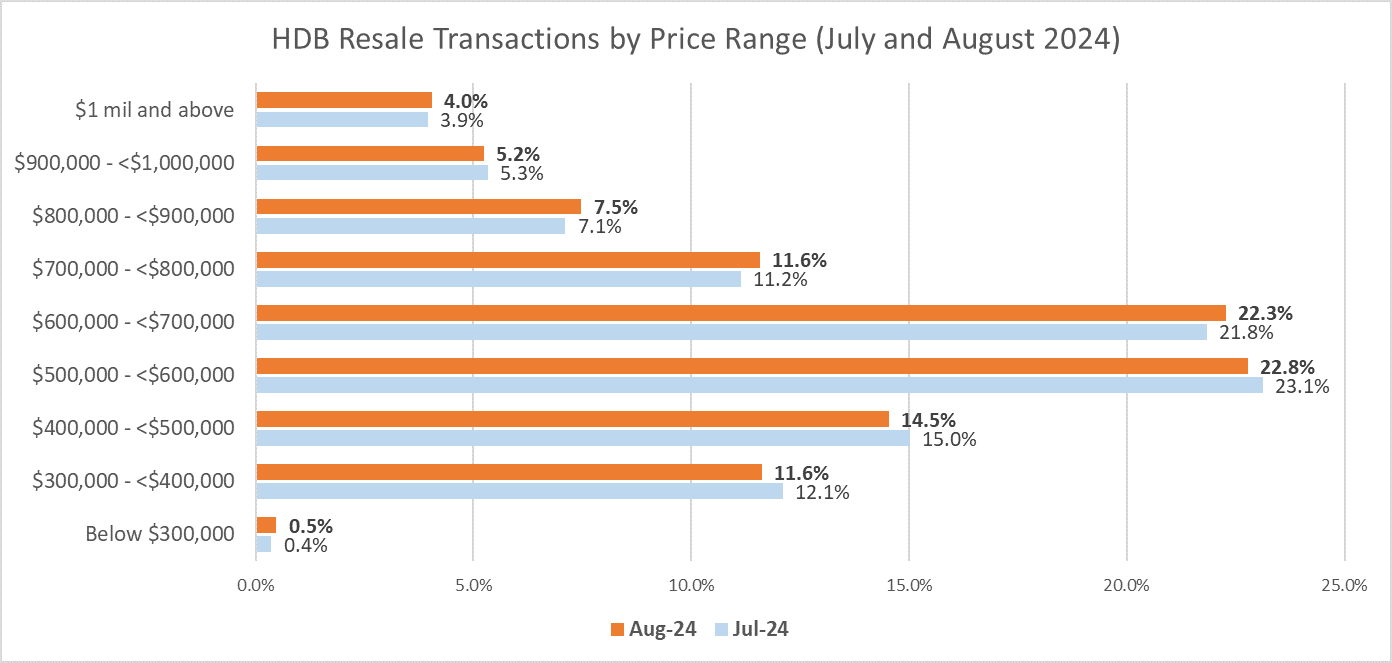

Transaction data showed that 26.6% percent of resale flats sold in August were priced at below $500,000 - slightly lower than the 27.5% proportion in July. Meanwhile, 69.3% of flats were resold at $500,000 to just under $1 million, which is marginally higher than 68.6% in the previous month. Resale flats sold for at least $1 million made up 4% of August's sales volume - relatively on par with that of July (see Chart 2).

Chart 2: Proportion of HDB resale transactions by price range

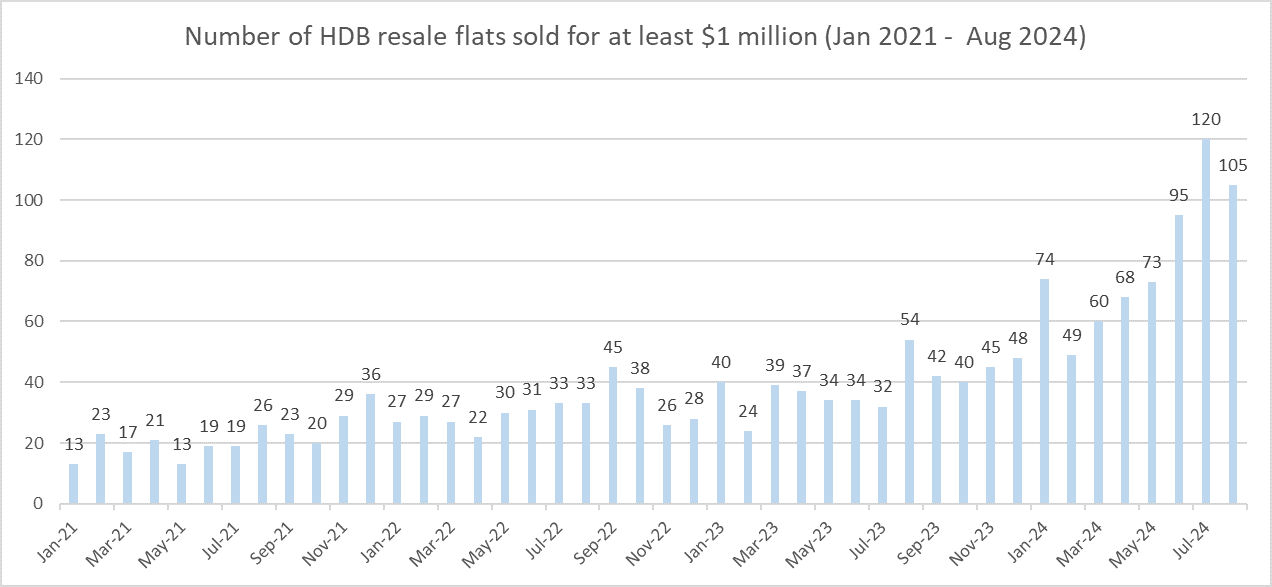

According to HDB's sales data, the number of million-dollar resale flats sold fell by 12.5% to 105 units in August (see Chart 2) from a record high of 120 units that changed hands in the previous month. All in, there were 644 such flats resold in the first eight months of 2024 - which is around 3% of the total HDB resale transactions over the same period.

Of the 105 million-dollar resale flats transacted, 14 units are located in non-mature estates, the highest number of such flats sold in non-mature towns on a monthly basis. They comprised five units each in Hougang and Woodlands, and one each in Bukit Panjang, Punggol, Sengkang, and Yishun. All units are executive flats with the exception of the two units of 5-room flats in Hougang and Punggol.

The remaining 91 units of million-dollar resale flats are located in mature towns: Kallang Whampoa and Bukit Merah (12 units each); Bishan (11); Ang Mo Kio (10); Toa Payoh (9); Geylang (8); Clementi (7); Queenstown (6); Central Area (5); Serangoon (4); Bukit Timah (3); Bedok (2); as well as Tampines and Pasir Ris (1 each).

By flat type, the million-dollar resale flats sold in August comprised 40 executive flats, 36 units of 5-room flats, 28 units of 4-room flats, and a 3-room terrace flat in Jalan Ma'mor.

The top resale transaction in August was for a 5-room unit at Pinnacle @ Duxton in Cantonment Road which fetched $1.48 million (see Table 3). The unit has a floor area of 106 sq m (about 1,141 sq ft) and is located on a floor ranging between the 40th and 42nd storey.

Chart 3: Number of resale flats sold for at least $1 million

Table 3: Top 10 HDB resale flats sold in August 2024 by Transacted Price

Town | Type | Street | Storey range | Floor area SQM | Lease start date | Price | PSF ($) |

| CENTRAL AREA | 5 ROOM | CANTONMENT RD | 40 TO 42 | 106 | 2011 | $1,480,000 | $1,297 |

| BUKIT MERAH | 5 ROOM | HENDERSON RD | 25 TO 27 | 113 | 2019 | $1,465,000 | $1,204 |

| CENTRAL AREA | 5 ROOM | CANTONMENT RD | 34 TO 36 | 105 | 2011 | $1,420,000 | $1,256 |

| BUKIT TIMAH | EXECUTIVE | TOH YI DR | 10 TO 12 | 146 | 1989 | $1,392,000 | $886 |

| QUEENSTOWN | 4 ROOM | DAWSON RD | 34 TO 36 | 95 | 2016 | $1,380,000 | $1,350 |

| CENTRAL AREA | 5 ROOM | CANTONMENT RD | 13 TO 15 | 105 | 2011 | $1,380,000 | $1,221 |

| KALLANG/WHAMPOA | 3 ROOM | JLN MA'MOR | 01 TO 03 | 181 | 1972 | $1,330,000 | $683 |

| ANG MO KIO | EXECUTIVE | ANG MO KIO AVE 3 | 13 TO 15 | 174 | 1979 | $1,320,000 | $705 |

| KALLANG/WHAMPOA | EXECUTIVE | BENDEMEER RD | 19 TO 21 | 146 | 1994 | $1,318,000 | $839 |

| BUKIT MERAH | 5 ROOM | BOON TIONG RD | 13 TO 15 | 115 | 2005 | $1,313,000 | $1,061 |

With the cut in the LTV limit for HDB loans to 75%, it may crimp the sales of pricey resale flats at the top end of the market, as buyers would have to fork out more funds to cover the difference in the amount of loan they could secure. PropNex anticipates that there could potentially be a slight pullback in million-dollar resale transactions in the near-term, as prospective buyers weigh their options and review their sums.